Business Insurance in and around West Des Moines

Calling all small business owners of West Des Moines!

Helping insure small businesses since 1935

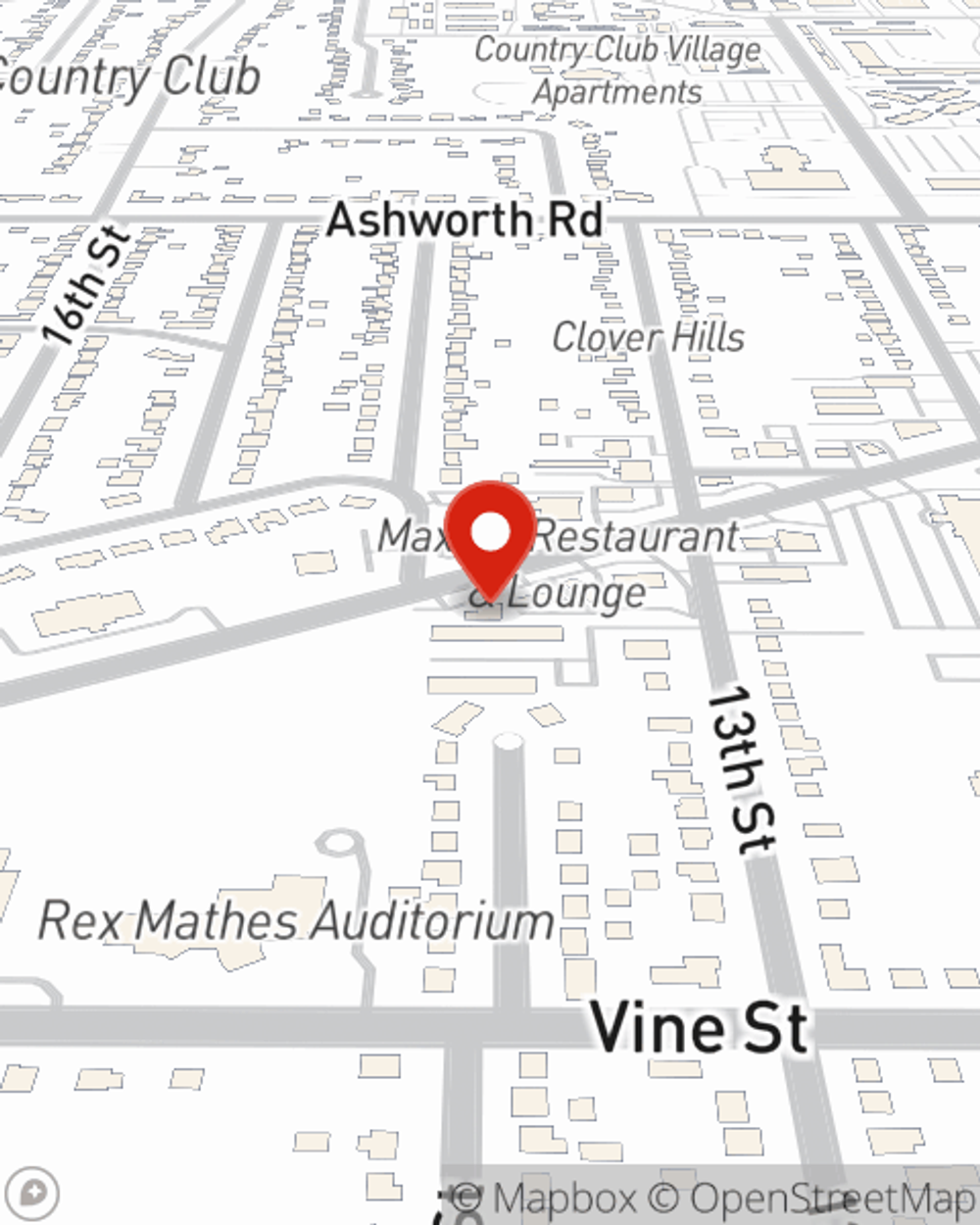

- West Des Moines

- Des Moines

- Clive

- Waukee

- Urbandale

- Ankeny

- Norwalk

- Windsor Heights

- Grimes

- Polk City

- Pleasant Hill

- Altoona

- Valley Junction

- Bondurant

- Polk County

- Dallas County

- Warren County

- Adel

- Van Meter

- Beaverdale

- Minnesota

- Missouri

- Nebraska

- Iowa

Your Search For Fantastic Small Business Insurance Ends Now.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or accident. And you also want to care for any staff and customers who hurt themselves on your property.

Calling all small business owners of West Des Moines!

Helping insure small businesses since 1935

Keep Your Business Secure

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like errors and omissions liability or business continuity plans, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent Steve Curren can also help you file your claim.

So, take the responsible next step for your business and visit with State Farm agent Steve Curren to discover your small business insurance options!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Steve Curren

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.